Flagright: How This YC-Backed Startup Fights Financial Crime with AI

Baran Ozkan founded Flagright to transform AML compliance with AI, enabling fintechs and banks to fight financial crime efficiently at scale.

Baran Ozkan, driven by a mission to revolutionise financial crime prevention, co-founded Flagright to equip financial institutions with cutting-edge AML compliance software. With customers spanning six continents, Flagright pioneers the use of AI in AML operations through its AI suite, AI Forensics—delivering unmatched scalability and efficiency. In this edition of Thought Leaders in Tech, Baran shares his story, lessons learnt while building Flagright, and how AI is transforming financial compliance and crime prevention.

Co-founders: 2 (Baran Ozkan, Madhu G Nadig)

Employees: 30+

Amount Raised: $3.2M USD (Pre-seed)

Core Technology: AI-native AML compliance platform, offering transaction monitoring, case management, risk scoring, and AML screening for fintechs & banks

Key Milestones:

- Backed by Y Combinator (YC), Pioneer Fund, and Moonfire Ventures

- Serving 50+ customers across 6 continents, with offices in Singapore, the US, UK, Germany, and India

- Proven AI capabilities for screening reduce false positives by 90% and cutting alert investigation time by 80%

- Fastest integration time in the industry; as little as 2 weeks

- Rated #1 globally for transaction monitoring, AML compliance and multiple other award categories on G2

The Story

Second time's the charm

Engineering to Entrepreneurship

I’m Baran Ozkan, originally from Turkey. I'm an engineer by training. My first experience living abroad was moving to the U.S., where I got my master’s and worked as a software engineer for five years. My first role was in healthcare insurance, a highly regulated industry that taught me how to operate in complex environments. Over the years, I worked across various industries—fashion, e-commerce, logistics, finance, healthcare, marketing, and insurance—which helped me develop a strong ability to identify big problems and build effective solutions.

I’ve always loved building things, but for a long time, I was just an employee building for other companies instead of doing my own thing. Before starting my current company, Flagright, I attempted to build an AI-powered travel companion called Audiotap, inspired by a frustrating experience with audio-guided tours at the Louvre museum in Paris. I had spent about half an hour waiting in line for a pair of headphones only to realise that they didn't work. Then, I had to wait another 30 minutes in line to get them replaced, which got me thinking, why the hell can't I just do this from an app on my phone? The idea was to replace these bulky, expensive audio tour guides with an app, capturing value in a market worth around $27 billion, as I later found out.

However, I soon discovered that there were several problems with the idea and execution for Audiotap. For one, the technology wasn’t there yet—generative AI didn’t exist, and text-to-speech sounded too robotic. On top of that, I didn’t know how to raise money, do sales, or find customers, and our business model was deeply flawed. The project failed, and I shut it down, but it was a valuable learning experience.

Founding Flagright

Later, I moved to Germany and then Lithuania, where I became Director of Product at a FinTech company, responsible for financial crime compliance—ID verification, fraud prevention, and money laundering detection. For two years, I struggled to find a real-time, risk-based monitoring solution. Half the providers lied about what their products could do—everything worked in sales calls, but when tested, they fell apart. The other half had issues like outdated APIs, unintuitive design, or just weren’t good enough. After two years, I couldn’t find anything worth buying. The few good ones were only affordable for massive banks like DBS and UOB.

Frustrated, I teamed up with my close friend Madhu, a brilliant engineer, to build the solution we wished existed. I quit my job, and we launched Flagright. We got into Y Combinator, landed our first customers, and in just two years, we’ve expanded to six continents, 30+ countries, and five global offices. Last year, I moved to Singapore to establish our HQ.

The Tech

An AI-native AML/Compliance platform to fight financial crimes

The Problem: Financial Crime, Money Laundering, Fraud

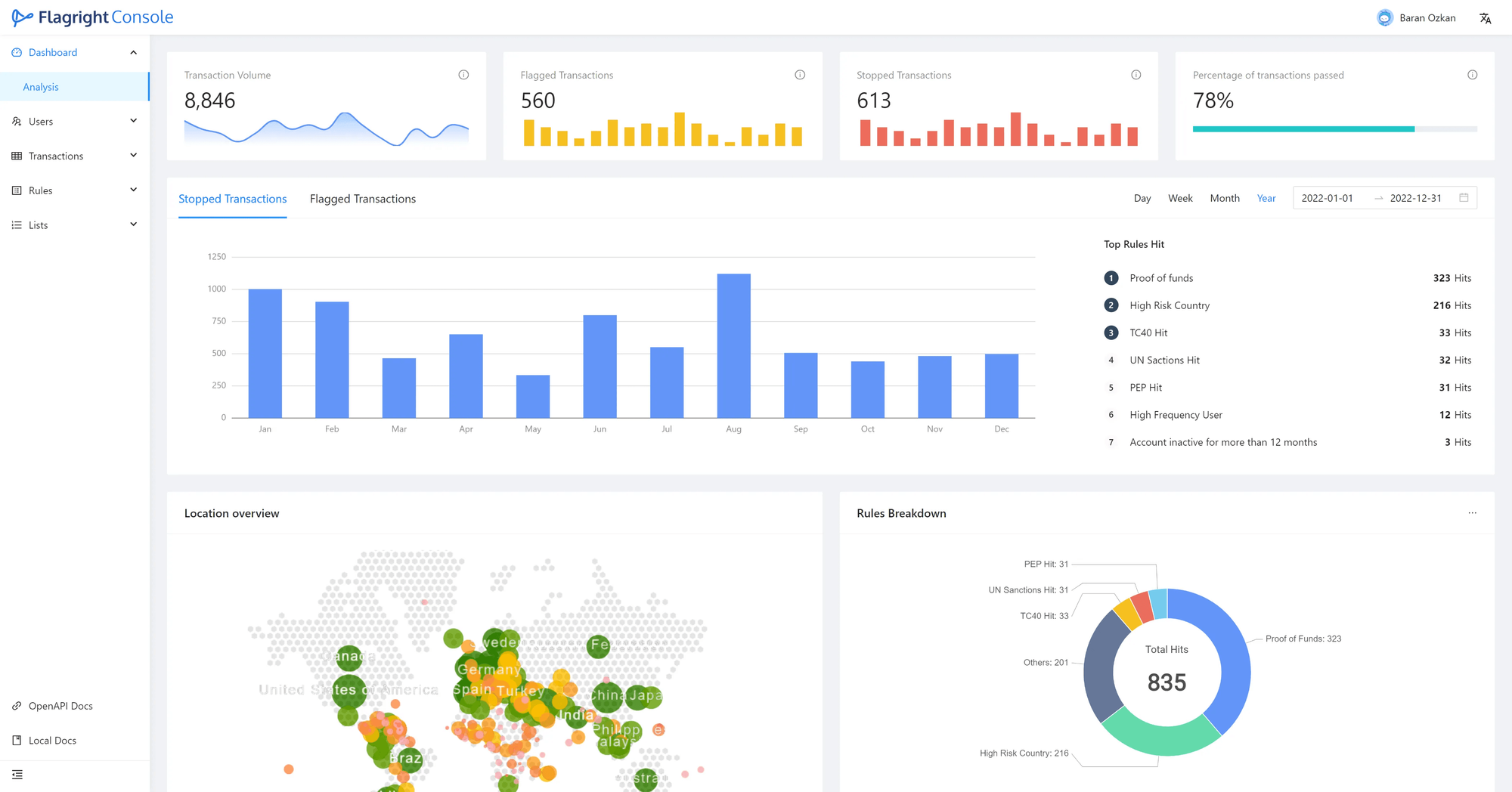

At Flagright, we work with financial institutions like banks, insurance companies, crypto exchanges, and neobanks to help them detect suspicious activities such as money laundering or fraud. For example, our system can identify transactions that might be tied to illegal activities like terrorism financing or large-scale fraud, such as the $2-$3 billion money laundering scandal in Singapore recently.

The Solution: Flagging Suspicious Transactions using AI and Rules-Based Detection

In a nutshell, our systems work by monitoring financial transactions for any signs of abnormal behaviour. For instance, imagine a grandfather, who's typically retired and doesn't make large withdrawals, using his ATM card at midnight to withdraw $1,000. This would trigger a red flag because it's unexpected based on his usual behaviour. Financial institutions can set rules, like flagging any withdrawal over a certain amount at unusual times based on a customer's age or average income.

In another scenario, if there are multiple transactions sent from a credit card to a crypto exchange within a short time frame, it might indicate an attempt to quickly move money from the credit card to a crypto wallet, possibly for illicit purposes. The bank could then freeze the card and notify the customer for confirmation.

Our system is designed to let users configure these rules with just a few clicks, making it highly flexible and efficient. We handle real-time processing, which requires a lot of compute power, as we deal with massive amounts of data. Not all of this requires AI, but for certain cases, we do use machine learning or generative AI to improve the detection process.

The Future: The Evolving Role of AI in Financial Fraud Detection

In the future, we expect AI to become more prominent, as it allows us to analyse even more data to identify suspicious patterns. For example, if we know that the grandfather regularly makes small withdrawals at midnight to buy beer with his friends, this context can help us suppress false alarms. The more context we have—like IP address history or past transactions—the better our system can clear alerts automatically, saving financial institutions money and human resources.

By automating these processes, banks can reduce the need for large teams to investigate suspicious activities, cutting down costs. The savings can then be passed on to consumers, such as by offering lower interest rates or better rewards, as financial institutions can operate more efficiently with advanced AI technology.

The Startup

Scaling a small YC startup into a global, award-winning player in the AML/compliance industry

Ideation & Validation

Put something out there, even if it isn't perfect

When it comes to ideation and validation, action beats information. The information you need to shape your idea only materialises if you take active steps to gather it. This means you have to do something—talk to potential customers, build a feature (even if it doesn’t work), or put something in front of people to gauge their reaction. If you show them even a broken product, they might say, I understand this and I would pay for it, and that’s valuable feedback. But if you don’t put anything out there, you’ll never provoke the responses that give you the information you need.

Never ask friends and family for feedback; ask your customers

You should never validate an idea with friends or family. They are completely useless for this, especially in B2B. They will tell you what you want to hear, not what you need to hear, which can be worse than getting no feedback at all because it can send you in the wrong direction. Instead, you need to talk to actual potential customers—people who will be brutally honest about whether they would pay for your product. If no one is willing to pay, you don’t have a business. Actions speak louder than words, so getting some kind of real commitment (e.g an LOI) would be more indicative of a good idea than if they simply say that they will pay for it.

Industry experience is an edge

I had a huge advantage because I was already in the AML compliance industry. I was on the buyer’s side before switching to the seller’s side, so I knew the exact problems and pain points. I wasn’t starting from zero—I was starting from one, which made a huge difference. I already knew who to talk to, what questions to ask, and what buyers were looking for. That industry knowledge gave me a head start in validating my idea effectively.

Building & Product Development

Put the problem first, define a minimum scope and avoid rigid frameworks

For us, the key was identifying the specific problem we were solving. In our case, there was no intuitive, real-time, risk-based transaction monitoring tool that was available for smaller companies. Once we identified the problem, we focused on understanding the necessary elements—what was missing and what needed to exist. This allowed us to define the minimum scope of the product and start building towards that. Afterward, it was all about gathering feedback and iterating based on what users wanted to continue polishing our product.

Personally, I find using specific frameworks for design and product development to be misleading. They often put you in a box and don’t work for all companies or people. When you follow a methodology, you’re just trying to play by the book without considering whether it suits your personality, your team’s culture, or the specific industry you’re working in. Execution capabilities also vary, so what works for one company might not work for another. It’s better to just do what makes sense to you rather than blindly following frameworks. In fact, I would advise against reading methodologies and frameworks altogether—they can be as dangerous as asking family for feedback.

Consider your business model and track key metrics, but understand that product-market fit is a moving target

Product-market fit is something you’ll never truly feel like you’ve fully achieved, no matter how fast your company is growing. There’s always room to sell faster and more. The concept of product-market fit depends on various factors, such as whether you're B2C or B2B, the type of product you're selling, how you charge people, and many other details.

For us, key indicators of product-market fit were things like

- the speed of our sales cycle,

- how fast we were acquiring customers,

- how we were generating prospects, and

- how people found out about us.

Metrics like revenue growth, retention, and net dollar retention (NDR) also helped us gauge where we stood.

Business Model & Monetisation

Iterate using customer feedback, then simplify for efficiency

Our business model and monetisation strategy changed around 20 times in the first year. It was very feedback-driven, with constant iterations. We’d propose a new model, and people would say, "That’s confusing," and suggest a different approach. We kept adapting based on this feedback. However, in the last 10 to 12 months, we’ve found more stability and maturity in our approach.

Now, we’ve settled on an annual payment model, where customers pay upfront for the full year. We don’t offer anything other than yearly payments. While this may seem restrictive, it streamlines our sales process by eliminating the need for customised payment plans. This allows us to close deals more efficiently, avoiding unnecessary negotiations that could delay the process. A straightforward pricing structure reduces friction in the sales cycle, eliminating lengthy negotiations and customisation that can slow down deal closures. Moreover, fewer payment options mean fewer customer enquiries, as too many choices can lead to decision paralysis. A clear, singular payment option makes it easier for customers to commit quickly.

Marketing & Sales

Use both inbound and outbound marketing strategies. For inbound, invest in brand and reputation. For outbound, tailor to your target market(s).

For our go-to-market (GTM) strategy, it's a mix of both outbound and inbound marketing.

For inbound marketing, we invest a lot in building our brand and reputation. For example, we’ve sponsored the Singapore FinTech Festival, Money 20/20 events, amongst several others, created content like blog posts, and collaborated with external magazines such as FinTech Singapore and ACAMS. We also engage with regulatory bodies like the MAS.

On the outbound side, we have a team that conducts research to identify potential customers and reach out to them via email, LinkedIn, or phone. We fine-tune these efforts based on the specifics of each market we’re targeting. When it comes to outbound marketing, I find that warm introductions work best, but LinkedIn is also a very effective tool for B2B businesses.

Have a personalised sales process

Sales for us really depends on the industry and the specific product we’re selling, since we have several product lines. Our product is complex, specialized, and mandatory by law—meaning that failure to comply could result in legal consequences, which makes the sales conversation different compared to more general products. It starts with understanding what the customer is looking for. Since we offer a range of 10 products, including AI agents, transaction monitoring, and financial crime investigator software, we tailor our solution to meet each customer’s specific needs. Once we understand what they require, we set up a demo environment to show them how our product works. After addressing their questions and confirming their needs, we proceed with more formal steps, like non-disclosure agreements, customization requests, and contract negotiations.

Fundraising & Growth

Be investable and know your "why"

The first step in fundraising is to ensure that you are an investable company. Fundraising should be a byproduct of having a strong product, a good market size, and the execution capabilities within your team. When you focus on building something of value, proving your ability to execute by generating sales and building the product, your metrics will naturally attract investors. Starting with the intention of simply raising money rarely works, as investors can sense when you’re more focused on the funding than on building something worthwhile.

When pitching, it’s crucial to communicate why you're building the product. Investors want to see if you have personal experience with the problem you’re solving, whether you and your team are capable of delivering, and if you are fully committed to the venture. If you’re not willing to take risks and work on the project full-time, it’s hard for investors to justify giving you a significant amount of money. Investors need to believe in your commitment as much as they believe in your business idea.

Use funds with ROI in mind, experiment and double-down on what works

We were very strategic with how we invested our funds. We only deployed money when we felt confident that we could get a return on investment (ROI). We also ran many experiments, like testing out new channels by investing significant sums—such as $100k—to see if they would work. Having funds allowed us the freedom to experiment and learn, which sped up the process. Without money, that experimentation would have been much slower.

In general, we took a step-by-step approach, releasing funds faster once something proved to work. For instance, I was personally responsible for closing the first $2 million in annual recurring revenue (ARR). Once we achieved that, we expanded by building a sales team and bringing in a global head of sales to scale further.

Team-Building & Leadership

Co-founders should fundamentally be friends

In terms of the co-founder relationship, for me, it’s essential to not just be business partners but also friends. Starting and running a company is full of tough moments, and if you're not friends, it’s easy for things to fall apart. There will be hard conversations, and sometimes things will get heated, but if you have that friendship, you have a way to recover. If you’re just colleagues, there’s no emotional protection, and that can lead to breakdowns in the relationship. Many companies fail this way. Hence, having a strong friendship with your co-founder is crucial for handling tough situations.

Intensity + ambition are key attributes for hires

We prioritise finding people who genuinely enjoy working and building things. For us, work isn’t something you do just to make money; it's a passion. We want people who take ownership and responsibility for their work. This creates a culture of high talent density and helps filter out those who aren’t a good fit. If someone isn’t up to the intensity of the team, they usually recognise it and leave, which is the kind of attrition we want. Intensity and ambition are key traits we look for in team members.

Balance receptiveness with decisiveness

The way I manage the team depends on both my personality and the company culture I want to build. Our company hierarchy is flat, so anyone can voice their opinions, and if your idea is better than mine and you can argue for it, we’ll go with it. However, there are times when I have to make a decision, even if it’s not popular. It’s important to understand that leadership isn’t a popularity contest; sometimes, tough, unpopular decisions are necessary to move the company forward. You have to balance listening to good ideas with the need to make hard choices for the business.

Overall, it's about balancing fostering a flat hierarchy with exercising decision-making authority – at Flagright, we foster an environment where ideas can come from anywhere but ensure that the team understands when we as founders have to make the overriding, hardline decisions.

How we structure the team at Flagright

If I had to draw an org chart for our current team, here's how I would break it down:

- Co-founders – My co-founder and I oversee everything from engineering to operations.

- RevOps (Revenue Operations) – This is a specialised key department, and underneath it, we have:

- Demand Generation (i.e Marketing)– Focused on generating inbound leads and building awareness.

- Sales – The team responsible for engaging leads to close deals and drive revenue.

- Retention – Dedicated to maintaining and growing relationships with existing customers. This is essentially our customer service department.

- Engineering – The team working on building and maintaining the products.

- Product Design – Focused on designing the user experience and the overall product.

- Operations – Includes multiple support functions like HR, legal, and accounting.

- Finance – Managing the financial health of the company.