Transparently: How a PhD Insight Became a Weapon Against Financial Fraud

Transparently was born from a simple question: what if you could detect accounting manipulation using data?

After a career spanning investment banking, macro strategy, and quant asset management, Hamish McAllister turned a PhD insight into a groundbreaking startup. Transparently was born from a simple question: what if you could detect accounting manipulation using data? Backed by the Monetary Authority of Singapore, Transparently is now leading a mission-driven venture to bring radical transparency to finance—using AI to expose what others can’t see.

Co-founders: 2 (Hamish Macalister, Mauro Sauco)

Employees: 10-20

Last fundraise: $3M USD (Pre-Series A)

Core Technology: AI to detect accounting manipulation and fraud in corporate financial statements.

Key Milestones:

- Current valuation ~$20M USD

- Finalist for the RegTech Association’s Innovator of the Year and Startup of the Year

- Featured in RegTech100

- Selected for Plug and Play's Fintech Accelerator, Google for Startups Accelerator and Franklin Templeton Fintech Incubator

The Story

A Former Macro Strategist’s Mission to Expose Accounting Manipulation

What's your story?

I’ve had a pretty unconventional career path. Most of my background is in finance, but it's taken a few unexpected turns. I started out at a boutique investment bank, which gave me broad exposure early on. That led me to a role as a macroeconomist at one of the biggest banks in Australia and New Zealand, but I quickly moved to the sell side, where I focused on investment strategy.

As a macro strategist, my job was essentially to interpret global events and translate them into investment insights, then flying around the world to pitch them to some of the largest fund managers. Over time, however, I became sceptical of macro narratives—they can be shaped to fit almost any view with selective data. That led me to adopt a more quantitative, mathematical approach and eventually become a full-fledged quant strategist.

I later moved to Hong Kong with Deutsche Bank to build a new quant team, and soon after, hedge funds started asking about the models behind my recommendations. So I took on a new role leading Deutsche Bank’s quant asset management team in Asia, based in Singapore. But when the global financial crisis hit, innovation dried up. It became clear I wouldn't be able to build the products I wanted to. That’s when I decided to take a step back and return to university for a PhD—one of the best decisions I’ve made.

After finishing my doctorate, I returned to run a quant fund. I embedded a small piece of my PhD research into the fund—a method for detecting accounting manipulation. I thought it was a minor feature, but every time I presented it to investors, they were stunned. I kept hearing that same reaction: “Wait, how are you doing that? I didn’t know that was possible.” That got me thinking—maybe there’s a bigger opportunity here.

Eventually, I secured a major research grant from the Monetary Authority of Singapore to explore whether this idea could be developed further. COVID hit around the same time, which gave me the perfect excuse to lock myself away and focus. The results exceeded expectations. That led to the founding of Transparently—a company built to commercialise the IP.

What keeps you going?

Starting up is insanely hard. You have to be willing to give up everything. For most of this company’s life, I’ve worked seven days a week, often incredibly long hours. That just comes with the territory. Every milestone feels like a major achievement, but each one only reveals a new set of challenges. The only way to sustain that kind of intensity is if you're genuinely passionate about what you're building. If it feels like just a job, it won’t last—you’ll burn out. For me, this isn’t work. It’s something I live and breathe.

Another huge factor is the team. Having the right people around you—people who are equally driven and who energise each other—is critical. I couldn’t have asked for a better co-founder. We both work incredibly hard, and more importantly, we both believe deeply in the social good of what we’re doing. We’re helping people—real people—in meaningful ways. And that’s a powerful motivator in itself.

The Tech

AI for Financial Fraud Detection

The Problem: Financial Fraud

We often hear about major corporate blow-ups—cases where companies are found to have fabricated their accounts for years. But what most people don’t realise is that this isn’t rare or isolated. Independent research in the U.S. shows that 40% of companies manipulate their accounts annually, and 10% commit securities fraud every single year. That’s one in ten listed companies. In dollar terms, this equates to over $1.5 trillion lost every year by equity holders in public companies alone.

That’s what we set out to fix. Most people assume auditors catch this kind of misconduct, but the truth is, they usually don’t. Studies show external auditors only detect wrongdoing 3% of the time—and that’s not due to negligence; it’s just not what they’re designed or resourced to do.

The Solution: AI For Detecting Financial Manipulation

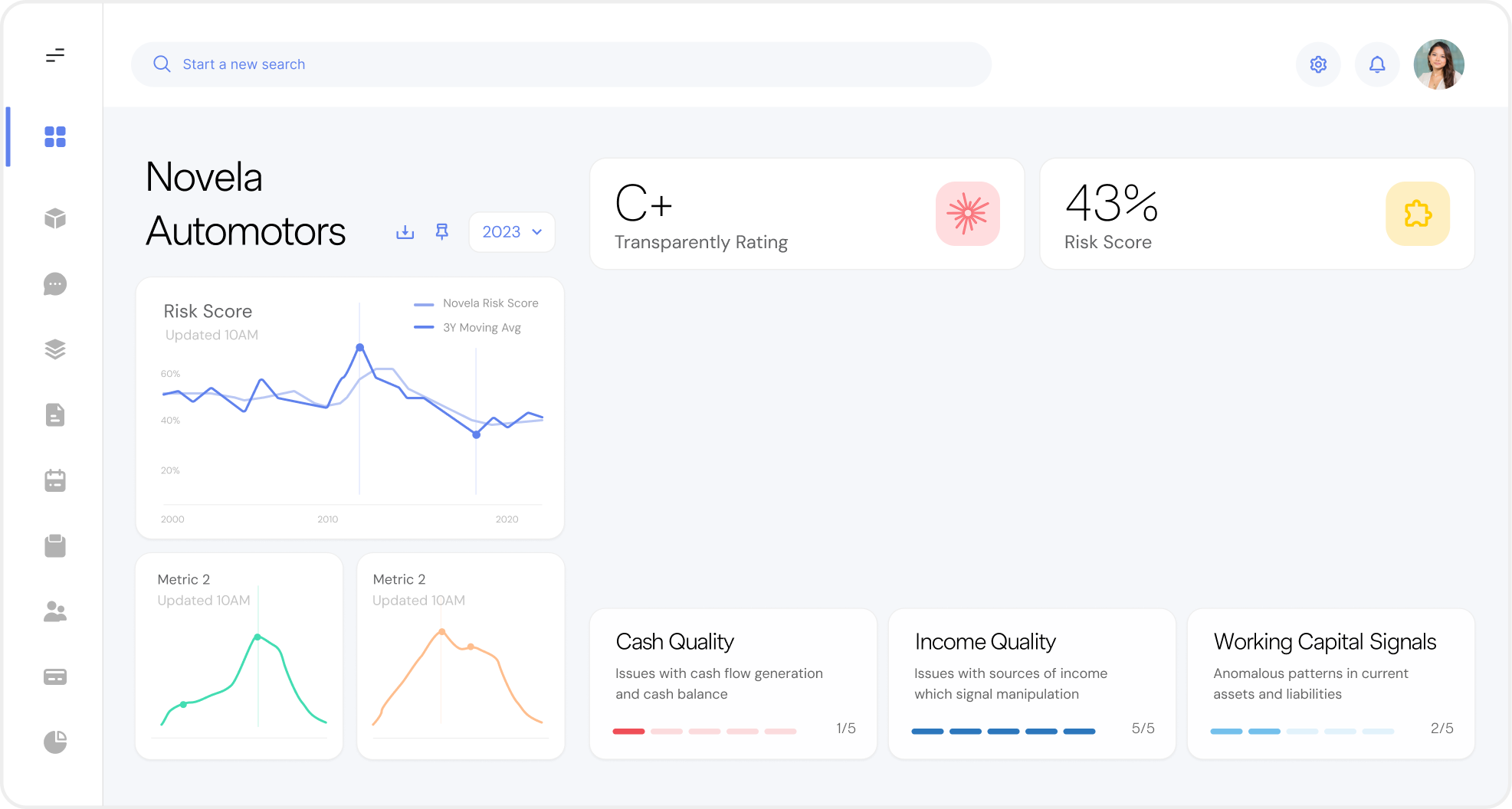

Essentially, we built a system to identify companies manipulating their financials—and to do it early. On average, our platform flags these firms two to three years before the market catches on.

At the core of Transparently is our proprietary AI engine—a predictive machine learning system specifically designed to detect financial manipulation. It identifies which companies are manipulating their accounts, the extent of that manipulation, how they’re doing it, and the likelihood of eventual collapse. On top of that, we’ve built a generative AI layer that interacts with the predictive engine, allowing users to interrogate the system in natural language. Together, these two systems combine deep financial analysis with conversational accessibility.

The Startup

Turning Groundbreaking Research into a Mission-Driven Startup

How did you come up with and validate the idea?

I was running a quant fund that included a small component focused on accounting manipulation. Whenever I brought that up with investors, even casually, I got the same reaction: “Wait—how do you do that?” People were shocked it was even possible. I kept hearing that response over and over, and it made me realise just how little awareness there was—especially among practitioners—about the academic research in this space. No one seemed to know how to evaluate financial manipulation as a risk factor.

That was the spark. To validate the idea, I successfully secured a research grant—something that would’ve been very hard to do without Singapore’s excellent ecosystem of funding opportunities. Of course, to get a grant like that, you need to prove you’ve got the expertise to turn research into a commercial product. It’s not research for its own sake—there has to be a clear pathway to real-world impact.

Once I had the funding and access to a test dataset, I spent well over a year working solo on a massive data science project. It was deep, hands-on research to test whether this early idea could actually be turned into a focused product—one capable of reliably identifying accounting manipulation at scale.

What was your process for building the MVP?

The first MVP was extremely rough—I built a basic user interface in Tableau that could connect to the underlying data and engine. Honestly, it was embarrassing in hindsight, but it worked well enough to let us experiment, interact with the system, and get a sense of its potential.

Because I had received a research grant from the Monetary Authority of Singapore (MAS), I went back to them and said, “Look, this could be something valuable—and potentially sensitive.” They agreed and introduced me to a few stakeholders, including a sovereign wealth fund. That fund became very interested and agreed to provide a small amount of funding to build a prototype for internal testing.

We built that prototype in about 8–10 weeks—still rough, but functional enough for them to run evaluations. They liked what they saw, and we were fortunate to sign a multi-year contract with them, which required us to deliver a production-ready version within six months. At that point, it was just the two of us—working full throttle to build that first real product. We delivered it 24 hours before the deadline. That was our first client. Starting with MAS backing and a sovereign wealth fund as our first customer—it was a dream launch for any deep tech startup.

How are you tracking product-market fit?

There are many ways people define product-market fit, but we take a very strict view. For us, true product-market fit means your sales process is so well-optimised that it becomes a machine. You know exactly which use cases resonate, who the decision-makers are, what messaging works, how to price and position the product, how it fits into client systems, and what your conversion rates look like from trial to contract.

By that definition, we’re not there yet. We’ve identified four key segments—banks, asset managers, auditors, and stock exchanges/regulators—and we’ve secured marquee clients in all of them. But we don’t yet have that level of repeatable, scalable sales precision. In our view, that’s something most high-performing startups aim to achieve between Series A and Series B.

How did you decide on the business model?

It’s been driven by continuous research. From the start, we’ve conducted deep market analysis to identify our core segments, the best use cases within each, and the specific benefits we offer—whether it’s risk reduction, profit enhancement, or productivity gains, depending on the stakeholder.

Pricing has been one of the toughest challenges, especially in the early stages. But everything has been shaped by detailed user feedback. At this stage, our pricing is essentially based on two factors:

- how much of the world you want access to, and

- how many users you need.

For example, access to all listed companies in a single market like Singapore has one price. Expanding to a whole region costs more, and global access with enterprise-level features, multiple users, training, and account management is priced at a higher tier.

How did you acquire your first 5-10 paying customers?

Early on, it was a mix. With limited resources, we relied heavily on word-of-mouth and organic inbound interest. There was a real novelty to what we were doing—solving a massive problem most people didn’t even realise could be solved—which generated a lot of buzz.

But organic interest only takes you so far. With additional funding, we began building out our sales, account management, and marketing functions. Those are all in place now, though they’re still evolving as we figure out the most effective strategies, identify the lowest-hanging fruit, and optimise for growth.

What are the most successful marketing strategies you've used?

Our most effective strategy has been content creation. We have someone in-house dedicated to writing research using our product—generating original insights and case studies. One of our most-read pieces is a case study on Wirecard, which attracted significant attention. We publish this kind of content on our website and drive traffic to it via platforms like LinkedIn.

We’ve also seen great results from speaking at industry events, especially smaller, focused events. Paid speaking slots at large conferences are often costly and less effective, so we’ve prioritised targeted engagements that offer better ROI without the hefty price tag.

Another major boost came from our participation in Google’s first-ever Gen AI Accelerator. Google was impressed with our tech and has since showcased us internally and externally as a success story in applied AI. In fact, they’re about to release a global customer success story on Transparently. It’s been a fantastic opportunity—free global exposure and a strong endorsement from a major tech platform we actively build on.

What is your sales process like?

Our sales process is relatively straightforward.

- It typically begins with an initial meeting—or a few conversations—which then quickly moves into a structured trial phase.

- Trials include a fixed number of users, and we require mandatory training before anyone gets access. That ensures users understand the system and evaluate it properly.We also charge a small fee for trials to ensure the trial is taken seriously.

- During the trial, we guide the client through the process to maximise the chances of conversion.

- If the trial is successful, we move to contract discussions—but our contracts are standard, so negotiations are usually minimal.

The biggest challenge is lead generation, but once we secure a meeting, we almost always generate strong interest. A high percentage of those initial meetings convert into trials, which then progress toward closing a deal.

How did you raise funds for Transparently, and what's your advice for conducting the pitch?

Early on, most of our investors were high-net-worth individuals from the region, largely brought in through word of mouth. We were seen as a novel, exciting tech company led by experienced professionals, which gave us strong credibility. Over time, that attracted inbound interest from larger players—including a prominent U.S. investment bank, which eventually came on board.

We’re currently in the middle of a new funding round, but this one is more focused on institutional investors. A number of VC firms are actively looking at us now, and we already have a few institutions on our cap table—with more likely to join in the coming months. So it’s been a natural progression: from a friends-and-family-style network to growing institutional involvement.

When it comes to pitching, the key is clarity. You need to present a very clear problem and a simple, compelling solution. The tech doesn’t need to be simple—but the explanation should be.

Equally important is trust. Fundraising isn’t just about capital—it’s about long-term relationships. So we prioritise transparency, strong communication, and good governance. It’s in our name—Transparently. We walk the talk, and it helps that our COO is a former internal auditor for financial institutions. That gives us a disciplined, detail-oriented approach to governance, which investors really value.

What's your strategy for using funds?

You need to know exactly how you'll use the funds before you raise them—investors will expect that clarity. How you allocate capital depends on the company’s stage.

At the early stage, most of the funding typically goes toward product development. But it’s important not to fall into the trap many tech founders do—over-building and under-selling. There’s a well-known idea that if you’re not a bit embarrassed by your first release, you launched too late. As a founder, it’s easy to fall in love with your product and become blind to its flaws—or defensive when users point them out. But their confusion or frustration isn’t their problem—it’s yours. We take that seriously. If a customer doesn't understand something, it’s on us to fix it.

As the company matures, spending shifts. In our current raise, for instance, about 65–70% of the capital will go toward sales and marketing, not product. That reflects the transition from building to scaling.

How did you meet your co-founder?

I met my co-founder years ago—our daughters were in the same class at school, and we started chatting at a family barbecue. We quickly realised we shared a deep passion for ideas, building things, and learning new skills—whether physical or technical. Over time, we bounced ideas off each other, some of which we explored together.

When I reached the point where I had built the underlying engine but lacked the experience to turn it into a product, I invited him to lunch to pitch him the idea. By coincidence, he had come to the lunch intending to also pitch me an idea, but for a completely different product. We ultimately decided to pursue Transparently, and he got permission from Google to work part-time until he eventually left to join full-time.

How do you manage working with your co-founder and your team?

The co-founder relationship is critical. Disagreements are inevitable, so mutual trust and respect are essential. It’s not about avoiding conflict—it’s about knowing how to navigate it professionally and constructively.

That mindset extends to the wider team. We have a formal “No Jerks Allowed” policy—outlining the behaviours we expect and won’t tolerate. We've passed on technically brilliant candidates because they weren't a cultural fit. In a startup, one toxic personality can damage the whole team. So while skills matter, culture fit is non-negotiable.

How is the team at Transparently structured?

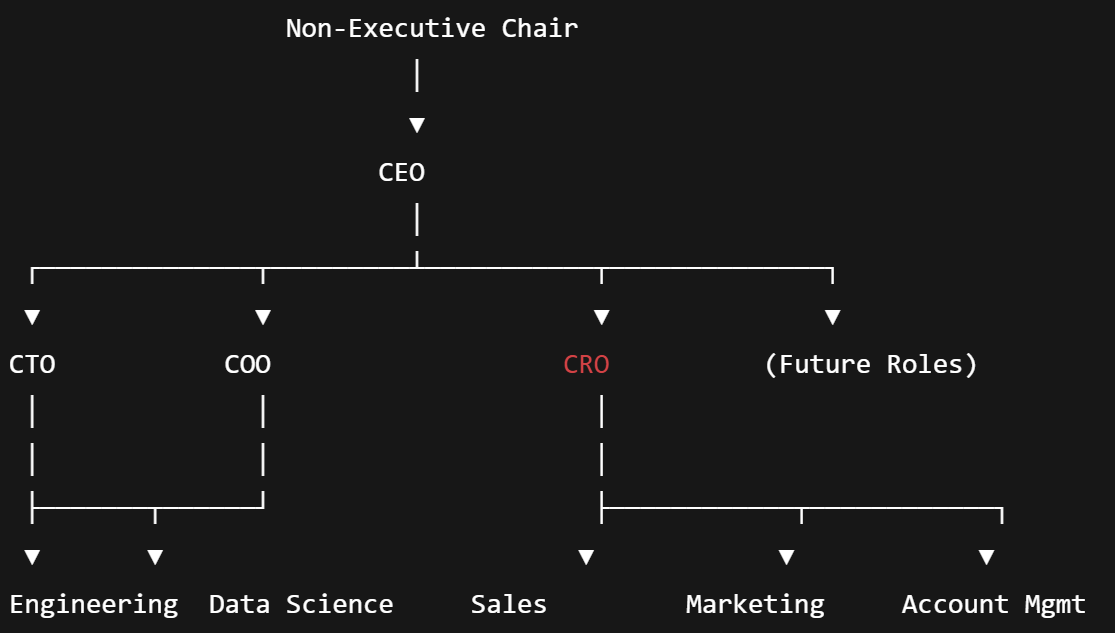

Our organisational structure is intentionally simple. We have a core C-suite consisting of:

- CEO – overseeing the overall direction and alignment of the company.

- CTO – responsible for all technology, including both the software engineering team and the data science team.

- COO – manages all internal operations.

- CRO – leads sales, marketing, and account management.

Each function reports up through its respective executive. The CEO works closely with a Non-Executive Chair, and we ensure strong cross-functional communication—especially between sales and tech—so that what we build is sellable, and sales feedback informs the product roadmap. We keep meetings purposeful and frequent enough to maintain alignment without overloading the team.

What's your daily/weekly workflow like?

We have a few regular internal meetings—management and operations meetings, sales meetings, and daily tech stand-ups to keep the technology team aligned. I stay closely involved with the tech side, given my role in building the core engine.

That said, a large part of my time is spent on external meetings—whether with partners, prospects, or the investment community. Even when we’re not actively fundraising, I’m often in conversations with potential investors to build relationships for the future.

To maintain some balance, I try to block out Mondays and Fridays as low-meeting days. It doesn’t always work, but the goal is to carve out time for strategic thinking—to step back, see the bigger picture, and figure out what’s next. You can’t do that if you’re in back-to-back meetings all week.